Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

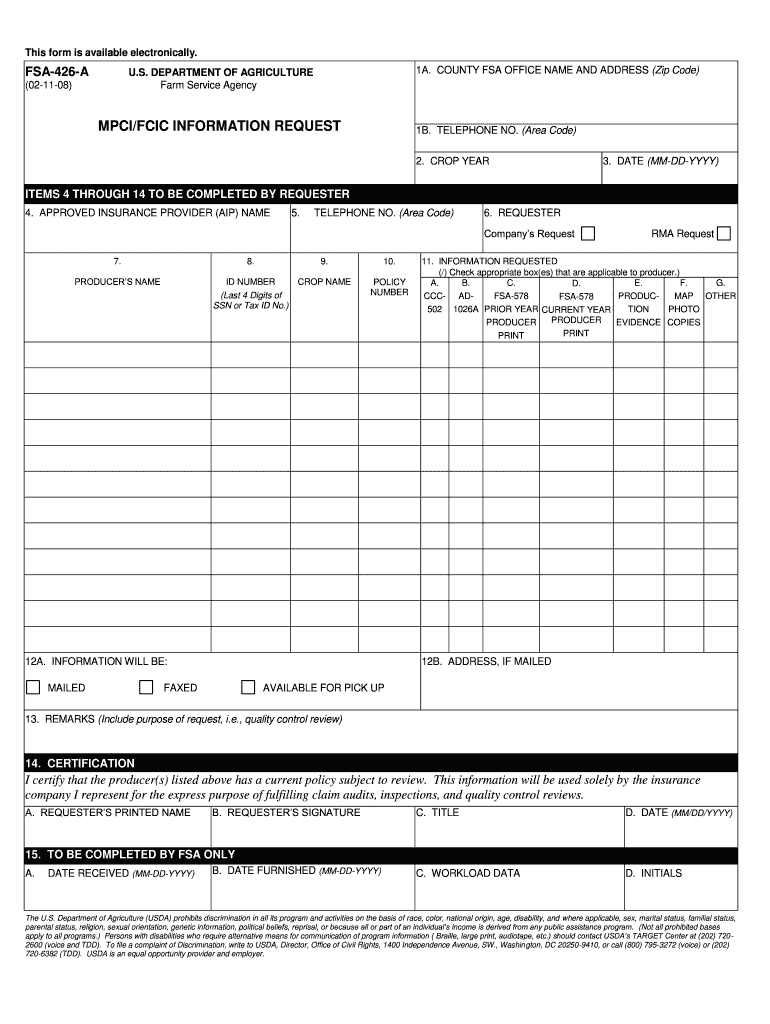

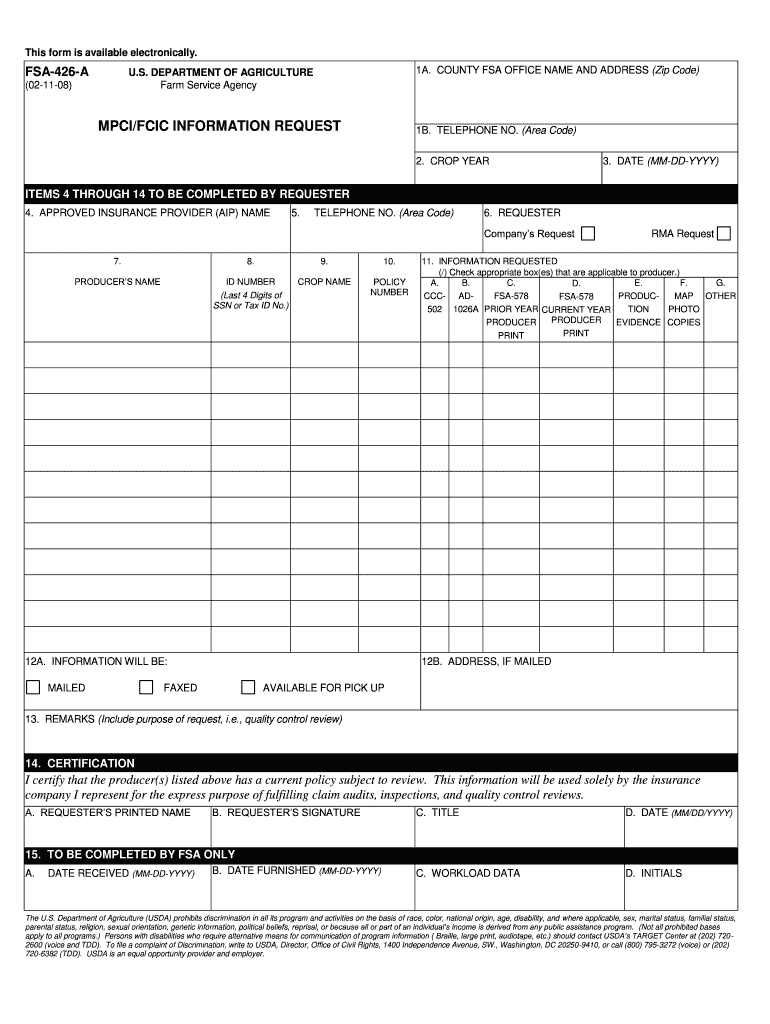

Who is required to file fsa 426?

FSA Form 426, "Report of Excess Cash on Hand," is required to be filed by all FSA-regulated entities, including banks, savings and loan associations, credit unions, and Farm Credit System institutions.

What information must be reported on fsa 426?

The FSA 426 form is the Federal Student Aid Reimbursement Request. It collects information about the amount of federal student aid funds that have been used for tuition, fees, and other education-related expenses. The form requires the student to provide their name, address, social security number, school, and the amount of money that was used. It also requires the student to list the type of expenses that the money was used for, such as tuition, fees, books, supplies, and room and board.

FSA 426 refers to a specific form that is used by farmers in the United States to report their production and acreage information for crop insurance purposes. The form is commonly known as the "Report of Acreage" and is administered by the Farm Service Agency (FSA) of the U.S. Department of Agriculture (USDA). It is important for farmers to accurately complete and submit this form to ensure they receive the appropriate crop insurance coverage and benefits.

To fill out the FSA-426 form, which is the application for FSA loan assistance, follow these steps:

1. Section 1: Applicant Information

Provide your name, contact information, and the type of entity of your operation (individual, partnership, corporation, or other). Indicate your tax ID number and the date your operation was established.

2. Section 2: Farm or Ranch Information

Describe your farming or ranching operation, including the total acreage, tillable acreage, and the principal commodities produced. Include information about any livestock, machinery, or equipment owned.

3. Section 3: Crop, Property, and Facility Information

Provide details about the crops planted including acreage, planting and harvesting dates, and number of acres insured. If you rent or lease farmland, include the landlord's name and contact information. Describe the facilities and property owned or used for the operation.

4. Section 4: Income and Expense Information

Report your annual gross income, including proceeds from sales of crops and livestock, as well as any off-farm income. Detail your annual operating expenses, such as seed, fertilizer, fuel, and labor costs. Include the value of any federal program payments received.

5. Section 5: Lienholder/Financial Information

List any outstanding loans or debts related to your operation. Include the name and address of each lienholder and the purpose of the loan. Indicate the amount owed and the status of the loan.

6. Section 6: Assistance Requested

Specify the type of FSA loan assistance requested (emergency, direct, guaranteed). Provide the amount requested and the purpose of the loan.

7. Section 7: Certification

Sign and date the certification statement, indicating that all information provided is true and complete to the best of your knowledge. Provide the name, title, and contact information of the individual completing the form.

8. Additional Documentation

Depending on the purpose of the loan, you may need to attach supporting documents such as financial statements, balance sheets, income tax returns, and proof of collateral.

Remember to review the form carefully before submitting it, as any incomplete or inaccurate information may delay the loan application process.

What is the purpose of fsa 426?

The FSA 426 (Farm Service Agency form 426) is a form used by the United States Department of Agriculture's Farm Service Agency (FSA) to collect information about livestock inventory and crops on a farm. The purpose of the FSA 426 form is to help determine the eligibility of farmers for various farming assistance programs and to calculate different types of farm loans and payments. It is used to document the inventory and value of livestock and crops, providing essential data to assess the overall financial health, production, and risk management on the farm.

What is the penalty for the late filing of fsa 426?

The penalty for the late filing of FSA Form 426, the Loan Limit Worksheet and Certification, may vary depending on the specific circumstances and regulations in place. It is best to consult with the relevant governing body or agency (e.g., the U.S. Department of Education for federal student aid) to determine the exact penalty amount and consequences for late filing.

How do I edit fsa 426 online?

The editing procedure is simple with pdfFiller. Open your fsa 426 form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit fsa form 426 in Chrome?

fsa426a form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit fsa 426 form print straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing fsa426 a form.